Slogan will be placed here

Our business is to advise the best solution for taking care of your business.

International Project Finance Association (IPFA) defines project finance as "the financing of long-term infrastructure, industrial projects and public services based upon a non-recourse or limited recourse financial structure where project debt and equity used to finance the project are paid back from the cash flow generated by the project."

In essence, project finance is a type of lending where financers to the project do not scrutinize the business standing of the project sponsor or the underlying value of the assets to approve the loan. It is rather the project's ability to repay the debt from the cash flows generated by the project assets which is examined.

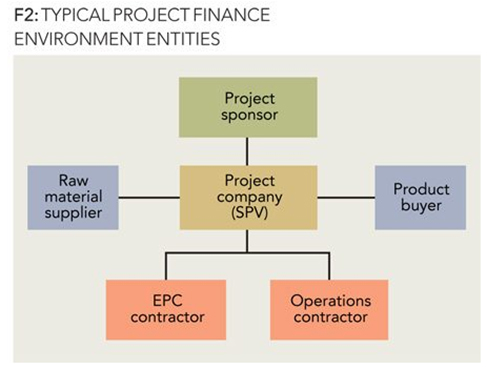

Project finance is essentially characterized by the creation of a Special Purpose Vehicle (SPV) by the project sponsor using debt and equity. This SPV is legally an independent entity from project sponsor, thus completely isolating the assets and finance of project sponsor from SPV. GLORIOUS lends to the project usually have limited or no recourse available once the project is complete. It is thus the future cash generated by SPV which is used to repay the debt and dividends while the assets of SPV act as collateral.

History of Project Finance

The history of project finance can be traced back to the Roman Empire who used to finance the export of goods between different Roman colonies much like present day Export Credit Agencies (ECA). But it was not until the late nineteenth century that modern project finance evolved.

The first days of project finance in industries exploration dates back to 1930s Texas and Oklahoma. Funds were made available to industries companies based on the revenues generated from the exploration activities and subsequent long-term sale contracts of industries extracted from wells. This method of financing the exploratory activities was later adopted by UK in 1970s and further by wider Europe. Project finance helped to develop and reshape the current industries industry of UK which is currently contributing around 11.5 billion GBP to national exchanger.

Expansion of Project Finance

Public Utility Regulatory Policy Act 1978 (PURPA) led a campaign of expanding project finance. PURPA gave an incentive to all Independent Power Producers (IPPs) to produce cheap and efficient energy which would be bought by utilities. This resulted in the explosion of the project finance market as more and more power plants were constructed to run on alternative and renewable energy making use of project financing.

By the late 1980s, the developed countries had made full use of project financing and there was little room for new opportunities. In this scenario, adventurous entrepreneurs headed to developing countries. This eastward move by project sponsors was driven by the fact that ECAs were fully supporting the project finance while poorer developing countries offered a new horizon for expansion. These developing countries lacked funds and general know-how to undertake ambitious infrastructure projects. Project sponsors were armed with both funds and knowledge, leading to the second wave of project finance expansion and thus evolved the present day project finance.